In this post, I’ll walk you through each step of using this tool, along with a practical example to demonstrate how it works. This is easy to do with a tool called the Strategic Risk Severity Matrix. For example, a big piece of machine wreck damage in a warehouse then people, assets along with repetition could be negatively impacted.I was recently asked to explain the “Impact Score” in a Strategic Risk evaluation process. Severity often affects pear which is an abbreviation of people, environment, assets, and reputation. Severe damage is identified and classified according to the harm percentage.

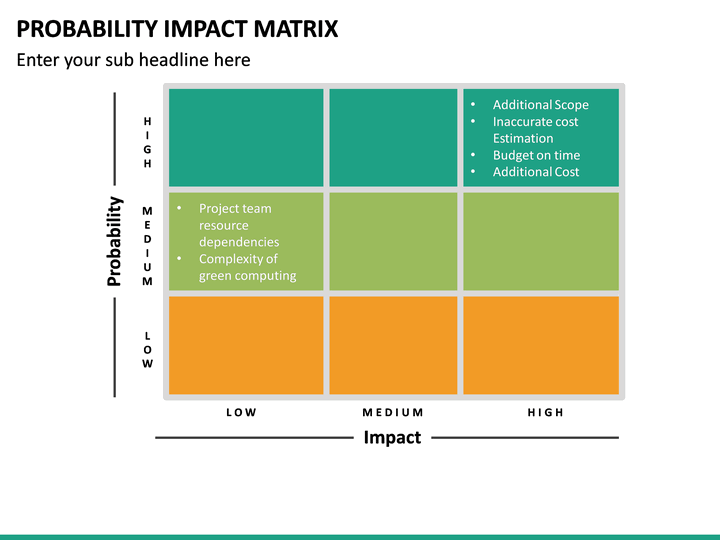

The amount of harm or damage that can be created by a particular risk is known as severity. While they are large on a qualitative scale, they may differ quantitatively, that is the amount of damage they may cause. This means that companies have to prepare themselves to face definite risks since they have the highest probability of happening and cause interference in the work. 5) Definiteĭefinite risks are the risks that have an 80% possibility of happening or even higher than that are to be termed as higher risks or definite risks. Businesses have to prepare themselves to face likely risks more often than not. As the name suggests the possibility of this risk happening is very rare and the percentage of risk in this particular category is considered to be less than 10%.Īs a business, it is crucial that they take these unlikely risks into consideration because, in the event that they occur, it would cause a huge loss for the business.Īs the name suggests likely risk is the one which has a possibility of more than 60% of happening. When the risk is not at all likely to happen, then it is classified as rare and it would be placed in this category of unlikely. Following are those 5 types of probabilities in risk matrix: 1) Unlikely Primary and the probability can be classified into five categories in which the risk can fall. With the help of both of these, the severity of the risk matrix can be determined. The risk matrix is presented in the form of a box where the left side of the box is the severity of the risk, while the bottom of the box denotes the probability of risk. When considering the basics of the risk matrix, there are two factors that are to be considered which are severity and the likelihood of the risk. With the help of risk matrix a company not only is able to identify the magnanimity of the risk but also is able to explain whether the risk can be controlled or should be avoided altogether.

Organizations want to be prepared for a particular event which may affect the business negatively and these particular events are known as risks. This is the reason why the risk matrix is plotted in order to understand the downside of the risk and the severity of that harm. There are risks associated in business at every point which and while it is important that risk should be taken in order to conduct business, it is also equally important to understand the outcome of the risk (or risk matrix) and the severity of it and if the organization can sustain such a blow. The potential outcomes from a particular decision are weighted and plotted on the risk matrix according to their severity. When there is a lack of guarantee pertaining to the outcome of a particular choice then that condition is called a risk.

0 kommentar(er)

0 kommentar(er)